In this Interactive Brokers review, we will discuss some of the benefits of the service, including account minimums and fees. We will also discuss trading platforms. If you’re considering investing with Interactive Brokers, this review should prove helpful. We’ve listed some key features below that make this broker an excellent choice. This review is not a comprehensive guide to investing with the company, but it can provide some guidance. If you’re new to the world of investing, we highly recommend taking a look at this service.

Investing with Interactive Brokers

In the world of investing, the Interactive Brokers website is the ultimate resource center. While the company’s services are ideal for experienced investors, it is also easy to get started. Its Lite tier allows new investors to get started without paying any commissions, while its Pro tier offers advanced traders low margin rates and robust trading functionality. Interactive Brokers was founded in 1977 and is based in Greenwich, CT.

For those investors interested in self-directed investing, Interactive Brokers Forex Review offers an automated portfolio option that allows you to control your investments. Other features include automated portfolios. With automated investing tools, you can choose to follow a predefined portfolio. However, for those who like to do their own research and want to avoid a large number of technical details, Interactive Brokers can make the process a breeze. But there are a few drawbacks to Interactive Brokers.

Fees

As a stock trading platform, Interactive Brokers has one of the most comprehensive offerings of any online brokerage. In fact, it leads the industry in international trading. However, its search function is far from intuitive. Using it requires you to submit your company’s document authorizing you to trade. Moreover, alerts are charged per request, rather than a flat monthly fee. While this isn’t a big deal, it’s still disappointing considering that Interactive Brokers charges a fee based on how many times you request them each month.

While Interactive Brokers touts itself as the most affordable online broker, it doesn’t necessarily offer the best value. Their fees are very low, but they include a number of loopholes. These fees include a small clearing fee, exchange fee, monthly inactivity fee, and subscription fees for live data. They vary based on their fee structure, the types of products they offer, and the countries in which they are offered.

Account minimums

An Interactive Brokers Review of account minimums reveals that there is no account minimum for online trading accounts. But if you’re looking for a brokerage that doesn’t charge account minimums, keep reading. The company has jettisoned its $10,000 minimum in favor of lower account minimums for cash and margin accounts. The company’s website even downplays the $10,000 minimum, making it easier for new investors to sign up.

Previously, the Interactive Brokers review mentioned that a $10,000 initial account funding was needed to open a brokerage account. That isn’t the case anymore. Currently, there are no minimum deposit requirements, but they’re still much lower than some other competitors. Interactive Brokers also recommends their services for volume traders, which means you must have $100,000 or more in your account and make at least $10 a month in commissions. Despite the low account minimums, the platform offers a feature-rich digital online trading platform and access to securities of all types and currencies.

Trading platforms

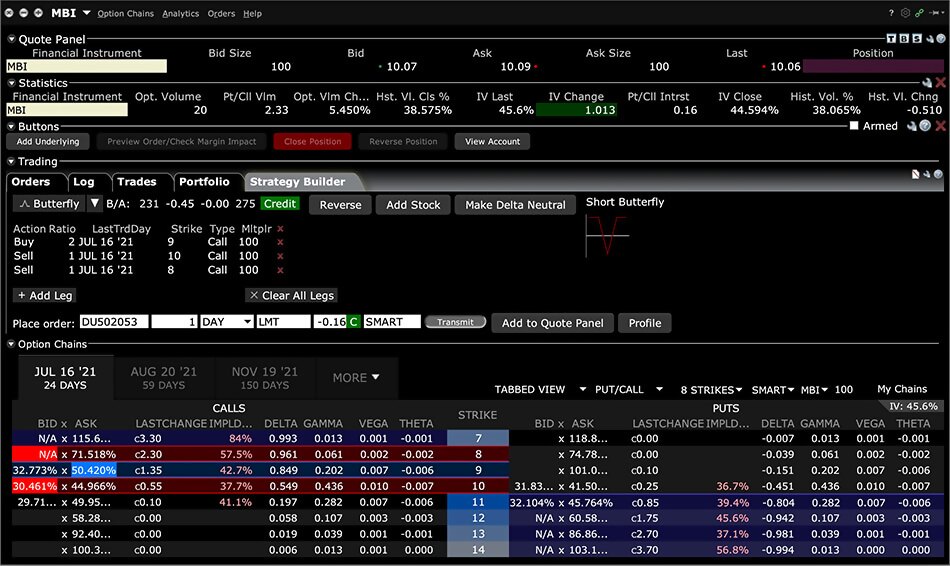

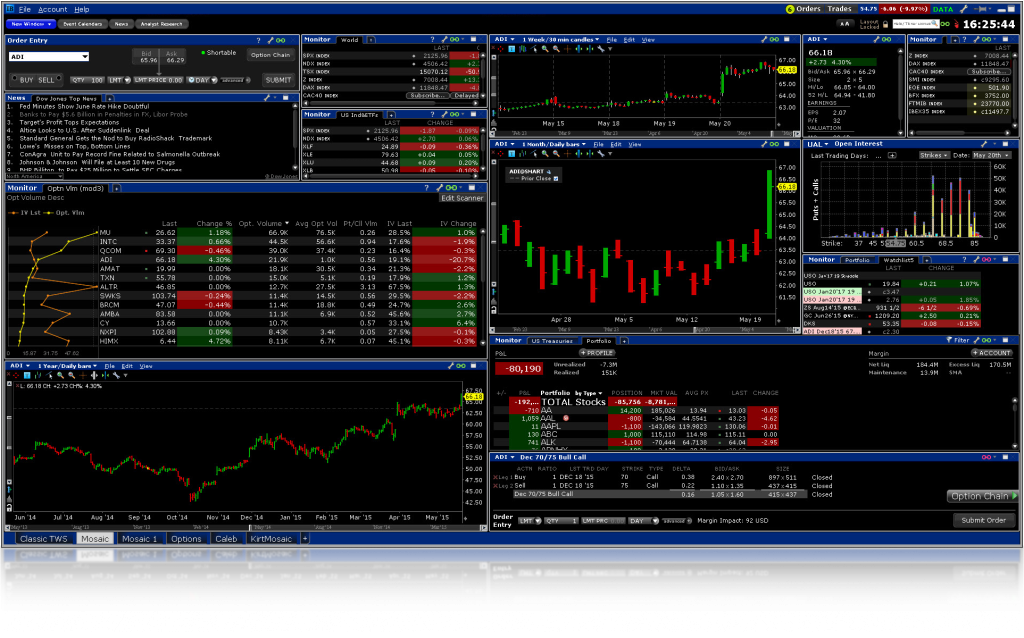

At Interactive Brokers and https://usforexbrokers.com/reviews/ig/ you will find a wide range of investment options, with prices starting at $0.05 per U.S. share. Options contracts can be bought or sold at 15-70 cents each, depending on the contract type. Interactive Brokers also offers tiered pricing on futures, with rebates of 25-85 cents on some contracts. It’s important to note that if you’re a new trader, you may want to consider the free stock trading offered to US clients.

Interactive Brokers’ trading platforms are designed for both beginners and experienced investors, but their mobile apps offer very limited data and are not as intuitive as those available with E*Trade. In addition to mobile apps, Interactive Brokers offers web-based courses and videos for beginners, making it easy to get started with investing. This is great news for beginners and more experienced investors alike. But be sure to check out the fees and terms before signing up.

App

The Interactive Brokers mobile app is a convenient tool for investors, allowing users to set alerts, receive text messages, and use order types. The app includes a chatbot, known as IBot, which can be used to ask questions, execute orders, or close positions. Interactive Brokers offers multiple account base currencies to minimize conversion fees. This is great for anyone who has limited time but still needs to do some trading. This app also provides a user with a full set of information, such as market data, and other tools that help them manage their accounts.

In this Interactive Brokers App Review, we’ve ranked its trading platform for novice and advanced traders. The platform offers superior education and a wide array of tools for both newbies and experienced investors. We found it to be easy to invest and use, and we’ve never had any problems with the app. Interactive Brokers is one of the most comprehensive online brokerages, and we’re happy to recommend it to those who are serious about investing.